PDF editing your way

Complete or edit your 2020 990 ez form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 990 ez directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 990 ez as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs form 990 ez by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 990-EZ

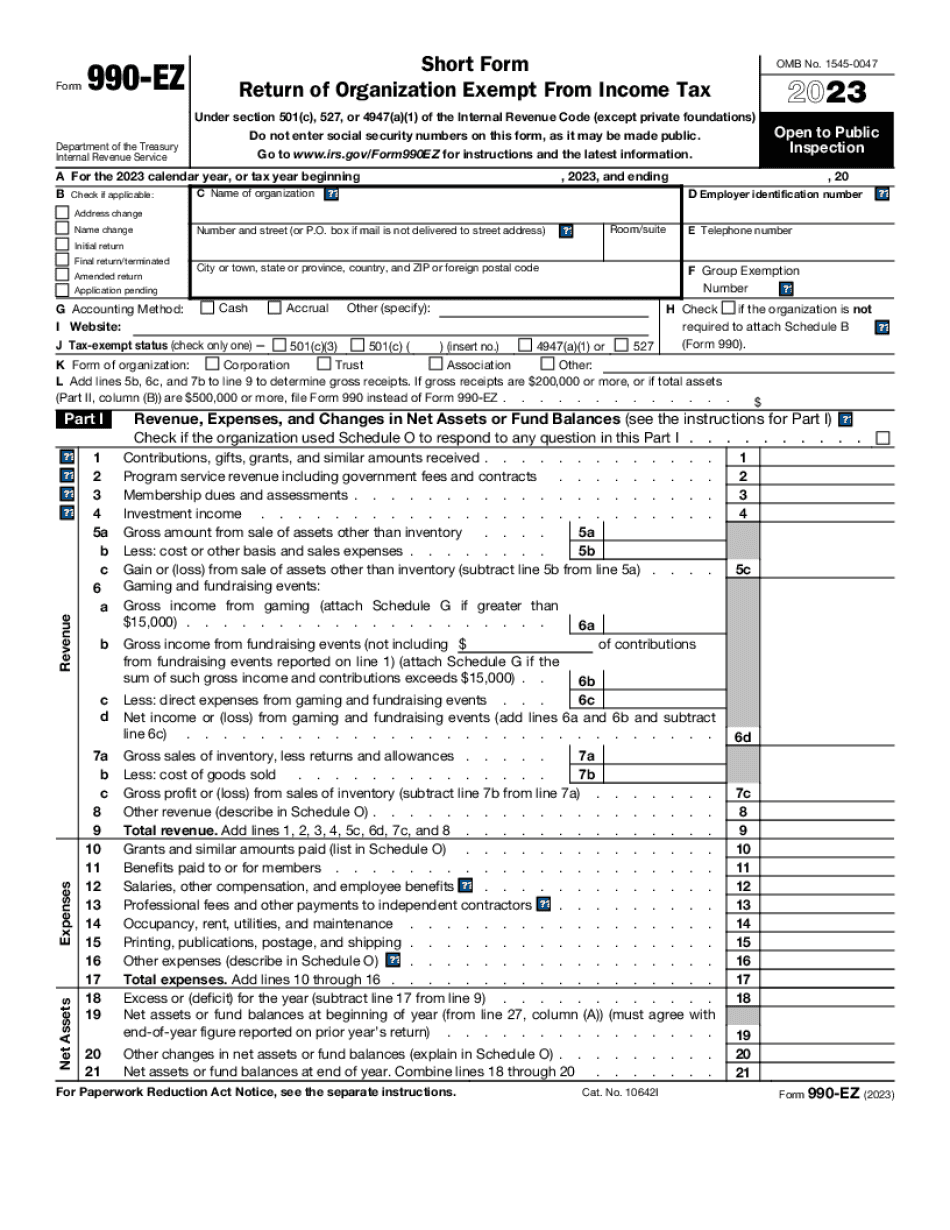

What Is 990 Ez?

The Form 990-EZ is required to be filled by entities and submitted with the Internal Revenue Service. The document works for all small tax-exempt organizations whose annual gross receipts are normally $50,000 or less. However, there are few exemptions.

This form isn’t intended for organizations that are included in a group return, churches or associations of churches and particular organizations required to file a different return. IRS requests demographic information and some other details about business activities.

Look through the list of what should be necessarily included to 990-EZ blank.

- current legal name of the entity and trade names used;

- mailing address and website address;

- employer’s ID number (FEIN);

- name and contacts of the principal officer;

- affirmation that the nonprofit is still operating;

- full accounting of income and expenses by category;

- awards and distributions given by nonprofit;

- details on income and expenses;

- list of team members, their contacts, hours worked and details regarding compensations, whether money or any other benefits;

- overview of the sources of income over the past 5 years;

- information about donors, if they give to the institution more than $5,000 during the whole past year.

Take an advantage of file the completed document electronically, wasting minimum time and efforts.

Online remedies aid you to organize your doc management and raise the productivity of one's workflow. Carry out the fast information in order to carry out Form 990-EZ, keep away from problems and furnish it in the timely way:

How to accomplish a Form 990-EZ internet:

- On the website with the form, simply click Start off Now and pass with the editor.

- Use the clues to complete the appropriate fields.

- Include your own information and get in touch with knowledge.

- Make convinced you enter suitable information and numbers in applicable fields.

- Carefully check the subject matter on the kind in the process as grammar and spelling.

- Refer that will help part for people with any thoughts or address our Support team.

- Put an digital signature on your own Form 990-EZ while using the guidance of Signal Resource.

- Once the form is accomplished, push Executed.

- Distribute the ready type through email or fax, print it out or help you save with your machine.

PDF editor allows you to definitely make improvements on your Form 990-EZ from any internet connected equipment, customize it as outlined by your preferences, indication it electronically and distribute in numerous options.