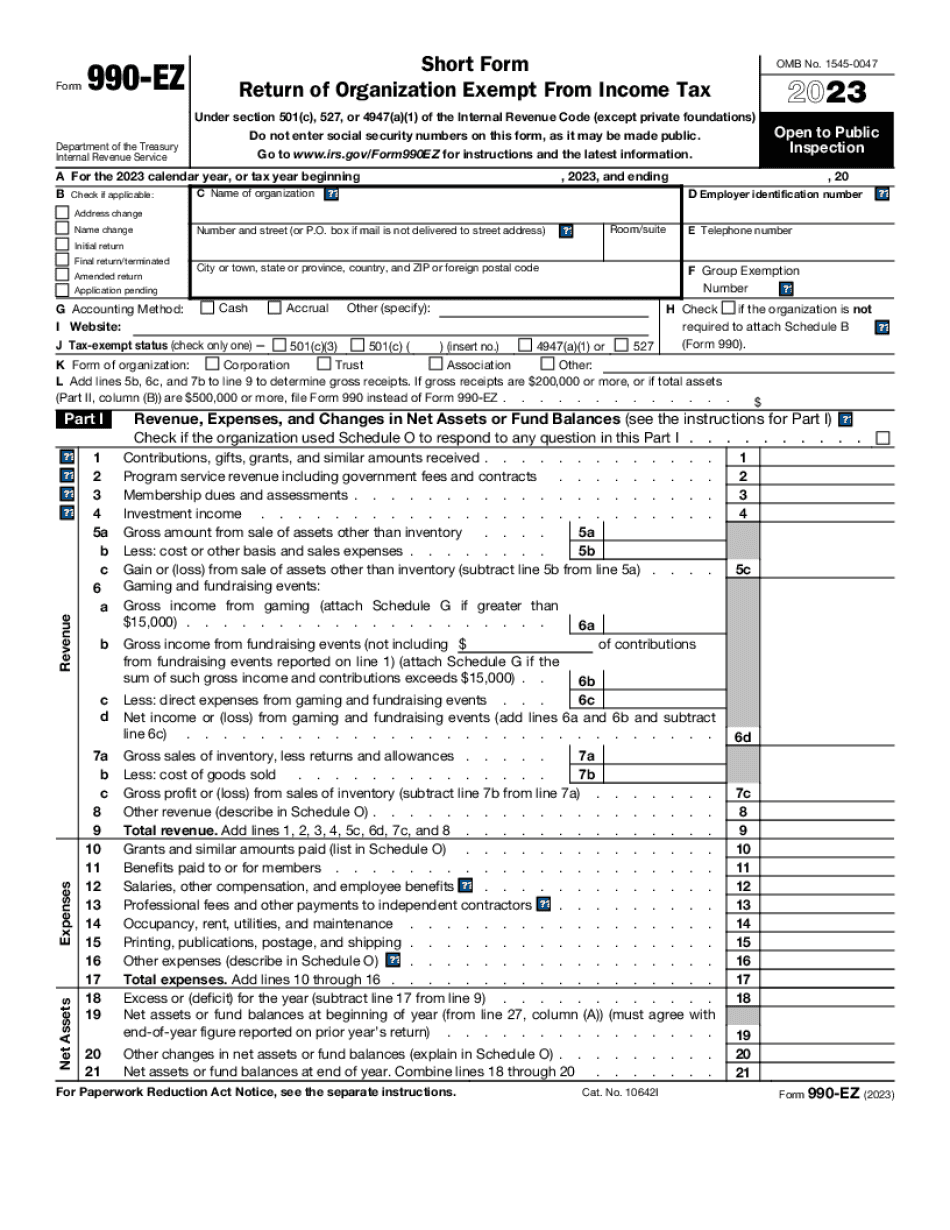

Downloadable PDF Form 990-EZ 2023-2024

Show details

Hide details

642I 6d 7c Form 990-EZ 2018 Page Balance Sheets see the instructions for Part II A Beginning of year Cash savings and investments. Did the organization engage in any section 4958 excess benefit transaction during the year or did it engage in an excess benefit transaction in a prior year that has not been reported on any of its prior Forms 990 or 990-EZ If Yes complete Schedule L Part I 35b 35c 37b 38a 40b on organization managers or disqualified persons during the year under sections 4912 ...

4.5 satisfied · 46 votes

form-990-ez.com is not affiliated with IRS

Filling out Form 990-EZ online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form 990-EZ

Every person must declare their finances in a timely manner during tax period, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form 990-EZ, our reliable and straightforward service is here at your disposal.

Follow the steps below to Form 990-EZ promptly and accurately:

- 01Upload our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official instructions (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Complete your template utilizing the Text option and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to stress specific details and Erase if something is not relevant anymore.

- 06Click the page arrangements button on the left to rotate or delete unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or select Mail by USPS to request postal document delivery.

Select the most efficient way to Form 990-EZ and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 990 Ez?

The Form 990-EZ is required to be filled by entities and submitted with the Internal Revenue Service. The document works for all small tax-exempt organizations whose annual gross receipts are normally $50,000 or less. However, there are few exemptions.

This form isnt intended for organizations that are included in a group return, churches or associations of churches and particular organizations required to file a different return. IRS requests demographic information and some other details about business activities.

Look through the list of what should be necessarily included to 990-EZ blank.

- 01current legal name of the entity and trade names used;

- 02mailing address and website address;

- 03employers ID number (FEIN);

- 04name and contacts of the principal officer;

- 05affirmation that the nonprofit is still operating;

- 06full accounting of income and expenses by category;

- 07awards and distributions given by nonprofit;

- 08details on income and expenses;

- 09list of team members, their contacts, hours worked and details regarding compensations, whether money or any other benefits;

- 010overview of the sources of income over the past 5 years;

- 011information about donors, if they give to the institution more than $5,000 during the whole past year.

Take an advantage of file the completed document electronically, wasting minimum time and efforts.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 990-EZ?

When an organization is forming or reorganizing, it must form an appropriate Internal Revenue Service (IRS) Form 990-EZ for the tax year. This form can be filed with the relevant tax returns. The Form 990-EZ is a tax return that details the organization's financial operations, including:

Annual reports

Accounting period financial records, including financial statements and related supporting documents

Employees' W-2 forms, W-3 and related supporting documents

Sector-specific financial records

The organization must show how it spent any assets given to it by the IRS in the form of “excess benefit agreements” and/or “contract payments and distributions.” As of 2009, the IRS requires that the following financial data be shown on the Form 990-EZ:

Net profit or gross receipts minus income tax and federal benefits

The amount of contributions received, if it is not listed and amounts are not known

The amount of income taxes paid, if it is not listed

All distributions or cash payments received which do not qualify for reimbursement or for a credit or refund under any IRS rules

An organization that is reorganizing is given the opportunity to change its reporting arrangements with respect to its financial operations in the form of Form 990-OEP. A reorganizing organization must provide the following information:

Audits

Records of transactions, if any, between the original and consolidated organization. (Incorporation are typically consolidated entities, whereas sole proprietorship and other business entities are considered separate entities under U.S. tax law.)

Transparent financial statements and auditor's reports if there are any, and other related supporting documents. (A copy of the auditor's report should be provided to the Internal Revenue Service at the time of the Form 990-OEP filing.)

Rehabilitation plan.

Who should complete Form 990-EZ?

Do you need an electronic version of Form 990-EZ? If so, can you provide that too?

This form is not meant for individuals to file for the sole benefit of reporting their income and deductions. Instead, it is intended to make reporting easier for businesses, nonprofit organizations, and other entity types. The form is available and accessible on our website, so the Form 990-EZ can be downloaded, e-filed, and distributed by any organization or business that chooses.

Who can use Form 990-EZ?

Only IRS-related entities — e.g., the IRS or the Internal Revenue Service. Businesses or groups claiming a “specified group rate” or “specified taxpayer rate” under section 5601 or 5601A may use Form 990-EZ for this purpose.

Entering Amounts on Form 990-EZ

Do I need to report amounts from my IRA contribution? Can my children or spouse do so?

Yes. Each IRA contribution you make is considered a taxable event for purposes of Form 990-EZ. You should note that your IRA balance should include the amount on Form 1040, your W-2, your wages. If your total contribution equals or exceeds the amount on Form 990-EZ, you will have to include that amount on your personal income tax return.

Does this form handle gifts?

Gifts are subject to gift tax. However, under some circumstances you may be able to treat a gift in one year as a contribution in the next year and avoid tax. See the Instructions for Form 990-EZ for more details.

Can you estimate the amount of Form 990-EZ you will have to file each year?

Yes. You can calculate the filing requirements for any year on the Form 990-EZ using the table or calculator that follows.

When do I need to complete Form 990-EZ?

To complete Form 990-EZ, you must file your most recently filed federal tax return using IRS Form 990, either online or through U.S. mail. Filer-to- filer taxpayers must submit their tax return to a different address than the filer responsible for filing the return. Each filer is responsible for all tax obligations on all returns filed. If one or more taxpayers fail to file a Form 990-EZ timely, the other taxpayers may be subject to penalties, interest and refund liability. If the IRS determines that certain returns are not timely filed, the IRS may impose a penalty of 25% of the overpayment. However, under certain circumstances, the penalty may be substantially reduced. See Rev. Run. 86-33, 1986-1 C.B. 442 (revised 1986-1 C.B. 616).

Taxpayers who will receive an extension for filing their return may file Form 990-EZ prior to the due date of their return if they have not previously filed an extension. If the tax return filing extension does not qualify as the “first return for which a return of tax needs to be filed,” then the return may not be required to be filed. See Extension of Time to File Under the First Return for Which a Return of Tax Needs to Be Filed, in chapter 1.

What if my tax return has been delayed, returned, or cancelled?

You may be able to postpone the filing of your return by submitting a request for an extension of time to file. If you are a taxpayer whose tax return was delayed for more than 60 days during the year as a result of an authorized audit or a criminal investigation, complete and submit Form 5329, Request for a Reinstatement, for each individual affected. You will also be able to apply the additional 30 days to file the 2017 return if you have not already submitted it. For information on filing the return, see Pub. 550, Tax Topic 530.

If you have cancelled the tax return, the account is closed and no longer available. However, the refund will remain available to the taxpayer. You may submit Form 2350, Cancellation of Return, to request a refund. If it is not filed by the due date for payment (including payments for any additional period allowed by statute), you may be required to pay the tax due on the cancelled return before you are entitled to recoup the tax plus interest, if any.

Can I create my own Form 990-EZ?

Yes. You can use Form 990-EZ to report investment income or gain.

What happens if I file an amended return?

If you file an amended return, the IRS will use the Form 990-EZ you filed with the original return to figure your tax owed.

If you file an amended return and have not filed Form 990-EZ, we will issue a notice of penalty for the return. We will calculate the penalties based on the total amount of net investment income (line 5 of Form 9435) and net investment gains (under line 2 of Form 990) shown on the amended return. The maximum penalties for the return period that you claim on your amended return are: 0% for tax years beginning after December 31, 1998;

3.8% to 10.0% for tax years beginning after December 31, 1999;

11.0% to 30.0% for tax years beginning after January 1, 2000; and

36.0% for tax years beginning after 2004. If you have a Form 990-PF or 990-PR that is not a Schedule C to Form 990-EZ, you still must file this form to file your amended return. However, you do not have to file the Form 990-EZ that you filed with the original return. You can check if your Form 990-EZ is an amended form using our Free File software. If Form 990-EZ is not an amended form, then the IRS will issue a notice of penalty for the return.

What should I do with Form 990-EZ when it’s complete?

For a Form 990-PF that is completed prior to June 28, 2012, do not use the following process:

Send Form 990-EA or 990-PF to the IRS.

For Form 990-EZ, make copies of your documents and send copy to us, along with your Form 990-EZ receipt from a financial institution or the IRS, electronically.

If you have questions about Form 990-EZ, or the receipt, you may contact the Revenue Manager, Information Retrieval, or the Financial Institution's Claims Management Specialist (FILM).

How do I get my Form 990-EZ?

Form 990-EZ is a paper copy of all contributions, deductions, and credits of federal income tax for the current year, for which you (or your spouse if filing jointly) are the taxpayer. The form contains line Itemized Deductions and Form 990-EZ does not provide the IRS with the name of any person who had to pay tax on that income.

I sent my form 990-EZ to the IRS because I had a disagreement with the IRS. What does it mean? Form 990-EZ does not give all the details of the tax situation in the case (e.g., deductions and credits), and it is not a complete statement of the tax situation in general. The IRS will use information in your Form 990-EZ to complete its assessment if you or someone else filed a separate return.

How do I get a refund of tax paid on the Form 990-EZ? You may be able to get a refund of the tax you paid on the Form 990-EZ, but there may be a delay before you are able to get it. If the IRS is unable to locate the Form 990-EZ, it will send you a check or send you the original, along with a notice that the IRS is waiting to get the Form 990-EZ. A fee may be required to be paid.

I heard about a Form 990-EZ. Is it true that this is a copy of the tax return you filed? The Form 990-EZ is a copy of the tax return you have filed (or your spouse's). The IRS used the Form 990-EZ to record a list of items to look at and calculate what portion of the income you reported was taxable. If you or someone else filed a return, the IRS had to record the information on the Form 990-EZ. It did not copy it. You would not be able to file one if you were still making Form 1040A (or Form 1040EZ, Form 1040-EZ).

How can I obtain the Form 990-EZ? You will be able to get the Form 990-EZ by email or by calling. You can also obtain a copy of the Form 990-EZ from the IRS or a private company.

I want to change how I receive Form 990-EZ.

What documents do I need to attach to my Form 990-EZ?

How do I attach tax tables?

You must attach the following documents to your Form 990-EZ.

Your tax return for the most recent tax year. This includes forms for the period for which you are filing.

Your Form 990-EZ (or any other tax return), if you are reporting an amended return.

Your application for state exemption from federal income tax.

Other supporting documents.

Do I need to list any expenses or credits that affect my credit?

Yes, if you use Schedule C for those items; all others are considered non-deductible.

Do I need to list nonitemized deductions?

No.

Can I use Form 990-EZ-EZ to report additional nonitemized deductions?

Yes. The only exceptions are as follows:

Medical expenses you must itemize and the amount of any insurance costs you pay. You must include each itemized deduction and any applicable medical expenses in the total amount of your itemized deduction.

Any itemized deductions for property taxes that are deductible under the Federal Internal Revenue Code for an additional year. See Taxpayers' Guide for U.S. Citizens and Residents Abroad (Pub. 519) for more information.

Deductions you incur to obtain or repair a vehicle purchased as a business asset, whether the vehicle is used by the business. See Pub. 519 for more information on those deductions. See Nonitemized Business Deductions (Nonresident Alien Individuals) for the general rule on the definition of a business asset and the exception for the costs of replacing used vehicles.

Deductions paid or reimbursed to you or to the employer-provided health insurance policy. See Pub.

What are the different types of Form 990-EZ?

There are several Form 990-EZ forms for your business. Most forms are prepared electronically which is very convenient. However, we also have Form 990S and Form 990-T.

The following are the different types of Form 990-EZ:

If only an annual report is requested, you should submit a completed Form 990-EZ covering the year ended December 31. You should also get your Form 990-S for that year on the filing date (or as close thereto as information is available). Form 990-EZ does not cover an early termination of employment/termination with a reduction in force (often called a “change in control”). For more information, see How To: Filing Online and Mailing Form 990-EZ.

A Form 990-EZ also reports your income tax return, your share of Federal income tax, and a tax refund. Although the form provides some information about your earnings and your business income and expenses, it does not make a statement of the amount of any contribution to the Federal deficit or the Government's obligation to repay the debt. In particular, the report does not contain a statement of the Federal deficit that arises from the business income for those years.

A Form 990-EZ is completed with a pre-printed page that lists the required information on the form. To request a paper copy of their Form 990-EZ, use the “Form 990-EZ Request Form” on the IRS website at.

How can I find Form 990-EZ?

Using form online or by calling the toll-free number.

A complete copy of Form 990-EZ in the original, or certified, or microfilm quality copy may be obtained free from the U.S. Government Printing Office (US GPO) at the following address:

U.S. Government Printing Office

P.O.

How many people fill out Form 990-EZ each year?

According to IRS forms filed for 2015, 5.1 million filers received an itemized financial deduction for charitable donations, and another 1.7 million received an itemized deduction for their business-related deductions.

In contrast, the IRS says that the IRS received 26,066 people with Form 990-EZ income for the year of 2015 and that it has so far received more than 21.5 million “individual returns reporting Form 990-EZ” since 1997.

This chart from the IRS shows that the more you donate to your charity, the less tax you pay.

What do the numbers reflect?

The above numbers tell you what kind of charitable donations will yield you a significant tax break. You can also calculate what tax benefits you will get by calculating the sum of the percentage differences that tax filers with the same total charitable contributions get compared to those who donate a less.

To find out what you can expect to get when you donate your time and skills to a charity, calculate your expected charitable donations by dividing your expected income by the number of hours you donate each year.

Example

In 2012, we lived in two different cities, Boston and San Francisco. Both cities have a population of about 6 million people and have both average temperatures of about 65 degrees.

Our expected donation for 2013 was:

Average Temp: 65.4 degrees

Our donation rate: 12.23 percent

We donated 689 hours of time during 2012 that cost us about 2,400.

What kind of donations are worth more and how much money do people make from donations?

The average value of a donation in 2012 was 2,000, which means that the average person who made a 2,000 donation did so for 15 an hour.

The average income for people donating a lot of money was about 50,000.

The average income for people donating a lot of time was between 35,000 – 75,000, depending on whether they also donated their knowledge.

Do charities collect more tax dollars if the donations are deductible?

Yes. The average deduction for an ordinary charitable contribution in 2013 was 5,500. (See the following chart from the IRS for the average charitable deduction for 2013.)

So we donated a total of 23,000 in 2012. We paid income tax of 6,903.40 on our donation.

Is there a due date for Form 990-EZ?

A. Yes. For Form 990-EZ, a quarterly disclosure can be filed by October 1 of each year beginning in 2000, after which a filing must be made every 12 months thereafter. The quarterly reporting is due by the 1st day of the quarter following the quarterly anniversary date to which the form refers, which is usually the 5th day of the quarter.

9. Can the employer request any other information I might have?

A. If you are required to report on IRS Form 990-EZ, then in addition to the information listed below you can provide the employer with:

Details on income paid in previous years (in a “Paid-In-Advance” fashion)

All cash and equity investments (but no stocks)

The identity of the individuals who will be receiving payments

Additional information that the company needs to verify the employer's compliance with IRS regulations including a recent audit

If you are an employee, the information listed above can also be included on the employee's W-2. If you are a non-U.S. resident non-farm employer, then your most recent reportable balance for a taxable year will also be provided for your entire workforce (i.e., not just the people who are paid).

10. If I was a U.S. resident non-farm employer, do I have to fill out Form 990-EZ?

A. Yes. All foreign corporations are required to file Form 990-EZ. However, non-U.S. resident non-farm employers must be based outside the U.S. to file Form 990-EZ.

11. If the Form 990-EZ is not filed, how do I complain?

A. If you believe that a non-U.S. resident employer does not meet the requirements for the withholding allowance, you may submit an anonymous complaint to the IRS.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here